This post is available as an info sheet: download here

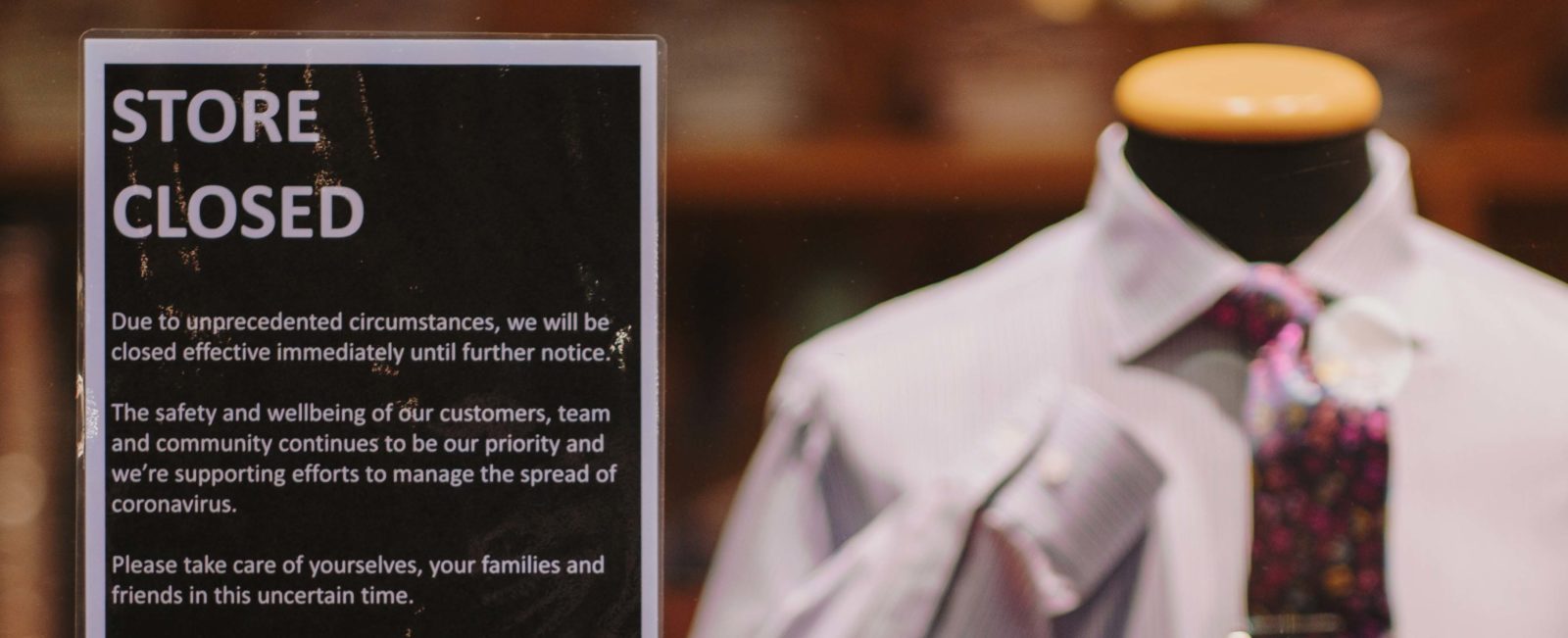

The COVID-19 pandemic has had a devastating effect on retail and other businesses, most of whom occupy leased premises, and will continue to do so for some time.

Tenants are not able to pay rent. Land owners who rely on that rent to service their mortgages, will soon fall into default. Land owners who do not have mortgages, or would normally have surplus income from rented properties, which they rely on for living and other expenses, will also be in financial difficulty.

In most cases, tenants that are unable to pay rent as a result of the pandemic, are at risk of having their leases terminated. Rent “abatement” clauses in most leases only apply where trading is affected by physical damage and it is unlikely that the common law doctrine of “frustration” will assist tenants to walk away from their lease commitments. It’s also very rare for leases to contain “force majeure” clauses and for those that do, it’s rare for them to extend to events like this pandemic.

The Commonwealth, State and Territory governments have signalled their intention to support an environment where businesses can “hibernate” during the worst of the COVID-19 crisis and come back to life after it is over. The National Cabinet has released a statement that it intends to agree to a ‘common set of principles’ that will underpin and govern an Australian response to these issues. However, States and Territories will need to act separately as they each have jurisdiction in relation to retail and commercial leasing issues within their States and Territories.

In NSW the state government has passed amendments to the Retail Leases Act 1994 and Residential Tenancies Act 2010 empowering the relevant Minister to make regulations under any relevant Act which may provide for the following matters, for the purposes of responding to the public health emergency caused by the COVID-19 pandemic:

- prohibiting recovery of possession by a lessor/owner/landlord

- prohibiting termination of a lease or tenancy by a lessor/owner/landlord in particular circumstances

- regulating or preventing the exercise or enforcement of another right under the relevant Act

- exempting a lessee/tenant or class thereof from the application of any provision under the relevant Act.

On 30 March the Victorian premier issued the following release via Twitter:

‘Today we announced a ban on rental evictions. From hospo to retail, if you’re struggling to get by due to coronavirus you won’t be evicted just because you can’t pay the rent. It’ll last six months – and it means one less thing to worry about for Victorians doing it tough’

The Victorian government will soon pass legislation to give effect to this ban or moratorium, and it is expected the legislative approach will be similar to that taken by NSW, giving broad regulatory powers to the relevant Minister.

The implications for land owners of this proposed moratorium on tenant evictions are uncertain and potentially prejudicial to land owners. We will need to wait for more details from the State and Territory governments as to how they propose to deal with these issues, but there is a limit to how far these issues can be addressed by legislation and regulation. For these reasons, the Prime Minister and State Premiers have urged land owners and tenants to talk to each other and endeavour to reach agreement on terms that will make this “hibernation” workable for both of them.

There are some common issues which may be relevant for consideration in discussions between land owners and tenants. These issues will depend on the circumstances of each lease, and the details of the legislative and regulatory measures implemented in each State and Territory.

Eviction – the proposed moratorium is on “eviction”, meaning a land owner will not be able to terminate a lease and take back possession during the moratorium period. It does not appear, at least at this stage, to provide for a release or waiver of rent during that period.

Waiver of rent? – consideration will have to be given as to whether the rent is to be waived for the moratorium period, or some other period. If the rent during that period is not waived, then it continues to accrue (with interest) and in theory a land owner would be entitled to commence a termination process immediately after the moratorium period ends.While many tenants will find it very difficult to pay rent during this period, waiver of the rent will have the effect of passing this commercial loss fully to the land owner, who may receive no corresponding relief for loan liabilities, other than deferral (see below). Other possible arrangements that could be considered by the parties, include waiver of default interest, deferral of the rent payment, possibly with repayment over time, subject to the business achieving certain post-pandemic performance hurdles or a restructure of future rentals, release of part of the debt or a combination of these measures.

Performance security – where tenants are in arrears, should land owners have the right to access performance security (e.g. cashing a bank guarantee) to apply to the rental arrears, without necessarily terminating the lease? No mention has been made so far in public announcements on this subject. It is possible, if not likely, that land owners will be prevented from accessing security with respect to pandemic related defaults.

Pre-pandemic defaults – there will be existing tenant defaults, and possibly enforcement and termination proceedings already in train, with regard to pre-pandemic defaults. As yet, it is unclear whether these will be affected by the moratorium. Will these be “frozen” until the end of the moratorium period? If so, this could be prejudicial to a land owner and possibly postpone the inevitable, and tie the land owner’s hands in the meantime.

Bank concessions – the Australian Banking Association has announced that Australian banks will provide a range of relief measures to certain land and business owners during the 6 month moratorium period. Land owners with total loan facilities not exceeding $10m, will be granted loan repayment deferrals (with interest capitalised), on condition they undertake not to evict current tenants for rent arrears as a result of the pandemic.

Small business owners (many of whom are tenants) impacted by the pandemic will also be granted loan deferrals for a corresponding period.

It will be important for land owners and tenants to clarify with their financiers whether they are offering relief, exactly what is being offered and what the terms of that relief will be.

Based on the public statements so far, the required undertaking not to evict tenants during the moratorium period will not prevent land owners simply postponing rental payments during the moratorium period, and not waiving them.

Early re-start – it may be that the impacts and restrictions associated with the pandemic subside earlier than currently anticipated. If a tenant is able to commence trading again after, say 3 months, should rent recommence, or perhaps partially recommence at that time (or perhaps a month later)? If partially, on what basis will that rental portion be determined? If an arrangement is agreed for early recommencement of rental (whole or partial) will this affect concessions granted to the land owner by the bank, and result in an early end or partial removal of the loan deferment concessions?

Outgoings – consideration should also be given to liability for rates, taxes and outgoings. The treatment of these expenses may vary in each case, and depend on the financial ability of parties to pay;

Unoccupied premises – the moratorium is intended to prevent land owners terminating leases and evicting tenants during the moratorium period. Therefore, tenants will retain possession of the premises during this period. For some leases, for example, stand- alone properties, thought should be given to whether the tenant can make use of the premises for an alternate purpose (perhaps not consistent with the permitted use stated in the lease), and possibly earn alternate income.

As the occupier under an ongoing lease, the tenant will normally have responsibility for securing and protecting the property. Thought should also be given to the cost of security and insurance, and whether the risk and insurance cost associated with an unoccupied building in the pandemic environment may increase;

Extension of term? – given that land owners will face loss of rent for 6 months at least, and the tenant may suffer absence of income for an equivalent period, it may be appropriate that the parties agree that the current term is extended for a term equivalent to the moratorium period, or perhaps longer;

Short term leases – where leases only have a short term left to run – for example, if they expire during the moratorium period or within a short time afterwards, the parties may prefer to end the lease by agreement. Consideration would have to be given to the possible impact on “loan concessions” granted by the bank for the duration of the moratorium period;

Renewal options – if a renewal option has been exercised, for example before the full impact of the pandemic became evident, the renewal will nevertheless be binding, unless agreed otherwise. Where the renewal term is to commence during the moratorium period, with a market rent review to apply, this review may be prejudicial to the land owner. Apart from the difficulty, and potential unknown impacts on market valuations during the height of the pandemic, it would seem unfair for the starting rent for a renewal term to be determined by reference to market rates at the height of the pandemic, in circumstances where the parties will in effect be “freezing” the lease arrangements for 6 months, with the land owner possibly foregoing rent for that period.

Where an option will be due for exercise during the moratorium period, or possibly during a post pandemic “recovery period”, it may be appropriate for the parties to agree to postpone that renewal. Alternatively, it may be agreed that the tenant commit to the renewal, and possibly an agreed commencing rental, as part of an agreement with the land owner for a range of “pandemic concessions”;

Rent reviews during moratorium period – where rent reviews (such as fixed percentage and CPI reviews) are due during the moratorium period, it may be appropriate that the review is calculated and the rent adjusted accordingly, but not take effect until the end of the moratorium period.

Market rent reviews during the moratorium period will be problematic – see our comments above. It may be appropriate for the parties to agree that market reviews are deferred until after the moratorium period ends, or the tenant is able to recommence trading. It may also be appropriate that a suitable “recovery period” be allowed before a market review, so that the market rent is determined in a more normally functioning economy (as far as that is possible) and not distorted by the extraordinary pandemic conditions; and

Land owner finance issues – any lease variations or restructuring will affect capital value as well as income, and be critical to ongoing finance arrangements for land owners with mortgages. Land owners must liaise closely with their financiers in relation to proposals and negotiations with tenants with regard to these matters, and obtain any necessary consent before concluding any new arrangements with tenants.

The National Cabinet has also announced a moratorium on eviction of residential tenants. This article is focussed on retail and commercial leasing, but we acknowledge that many land owners who have invested in residential rental properties will face substantial difficulties where rental income is affected, in circumstances where the land owner is prevented from taking any action. The JobKeeper support package announced by the Commonwealth Government on Monday 30 March may have an impact on this particular sector, not anticipated when the eviction moratorium was announced. It would be unfair if residential tenants, with the benefit of this income support, were in a better position to afford to pay the rent, but could avoid doing so, while the land owner was unable to take any enforcement action.

The impacts of the pandemic on our society and economy are massive, unpredictable and changing on a daily basis. The effects on legal and commercial arrangements affecting real estate and leasing will be difficult to predict, but undoubtedly significant. There are no legal precedents for responding to these momentous events. The issues are extremely complex and will involve a mix of legal, regulatory and commercial measures.

We will keep our clients updated and assist them navigate the developments in this area. As always, do not hesitate to contact our property team to understand how COVID-19 might be impacting your specific circumstances.

Steve Aitchison

Principal

Melbourne

T +61 3 8602 9217

F +61 3 8602 9299

E [email protected]

Francis Qi

Lawyer

Melbourne

Emily Clapp

Graduate-at-Law

Melbourne