On 15 June 2017, the Senate passed the ASIC Supervisory Cost Recovery Levy Bill 2017 and related bills to implement an industry funding model for the Australian Securities and Investments Commission. Regulations that provide additional detail on the operation of the industry funding model have now been made. The new scheme commences on 1 July 2017. Division 2 of Part 3 of the regulations relates to entities that are part of the deposit-taking and credit sector. Entities may fall within multiple subsectors within the sector depending on the activities they undertake during a financial year. The levy is calculated on business written of the relevant type. For the credit sector:

- the credit sector will pay for the cost of its regulation by ASIC

- ASIC will levy each licensee with the notional cost of its regulation

- levies will either be a ‘flat rate’, a ‘graduated rate’ or a combination of both.

- Where a licensee enters the industry during the course of a year, levies may or may not be at a pro-rata rate.

Credit sector to have a base levy and a graduated levy

Levies will apply to:

- credit intermediaries

- credit providers

- deposit product providers

- payment product providers

- small amount credit providers

As stated in the explanatory statement:

- Credit intermediaries (holders of an Australian credit licence that authorises the entity to engage in credit activities other than as a credit provider).will have to pay a minimum levy of $1,000 and then a variable amount depending on the number of credit representatives each entity has. (Regulation 25)

- Credit providers (same meaning as in the National Consumer Credit Protection Act 2009) will pay a minimum levy of $2,000. Credit providers that provide more than $100 million in credit contracts will also pay a variable component depending on their share of the total value of credit contracts above the $100 million threshold provided in a financial year. (Regulation 26)

- Small amount credit providers (same meaning as in the National Consumer Credit Protection Act 2009) that also provide credit under small amount credit contracts will also have to pay an additional levy calculated by reference to each entity’s share of the total amount of credit provided under SACCs issued by the subsector in the financial year (Regulation 24). In addition, a minimum levy of $2000 will also apply on the basis that small amount credit are also credit providers (refer to Explanatory Memorandum)

- Deposit product providers (holders of an AFSL Licence that authorises the holder to deal in a financial product by issuing deposit products) will pay a minimum levy of $2,000. Deposit providers that more than $10 million in deposits in a financial year will also a variable component depending on their share of the total value of deposit products above the $10 million threshold held in the financial year.(Regulation 27)

- Payment product providers (holders of an AFSL Licence that authorises the holder to deal in a financial product through which, or through the acquisition of which, non-cash payments can be made) will pay a minimum levy of $2,000 and then an additional amount based on net revenue from payment product activity (Regulation 28)

The consumer leasing sector is not mentioned in the Explanatory Statement, nor the Regulations. While it might be tempting to assume that providers of consumer leases will be treated as credit providers, this does not sit well with a plain reading of the credit legislation.

Levies also apply to other sectors

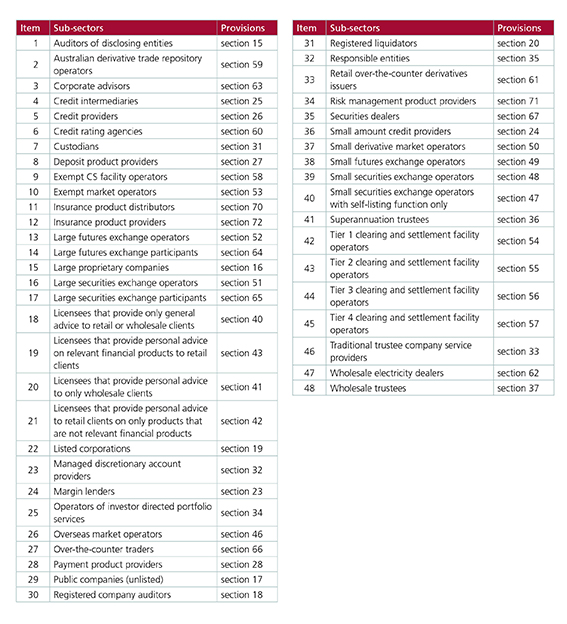

A reminder that the ASIC Levies will apply to all sectors regulated by ASIC, including as set out in schedule 1 of the regulations: