Real estate transactions in Queensland are facing significant changes, including a mandatory seller disclosure statement, as a result of the Property Law Bill 2023 (expected to soon become law).

Following a thorough review and report published (over 5 years ago, in 2017) by Queensland University of Technology’s Commercial and Property Law Research Centre, the Queensland Government has decided to adopt this regime and impose it as part of the new Property Law Act.

Why?

Some seller disclosure obligations already exist, but those obligations have been imposed in an ad hoc manner from different sources. This means that they apply at different times, in different ways and may have different consequences. Having a consistent model for seller disclosure is one of the goals of introducing this sort of broader requirement (see section 2 of QUT’s final report). There is also an overall goal to give a buyer useful information early, to help them with making a decision to purchase.

Also, though this issue was not listed as a major factor in the report: Queensland law around seller disclosure has been out of step with the law in New South Wales, the ACT, Victoria, and South Australia for some time. While being out of step doesn’t usually bother we Queenslanders, that inconsistency may have finally become a factor.

What is required?

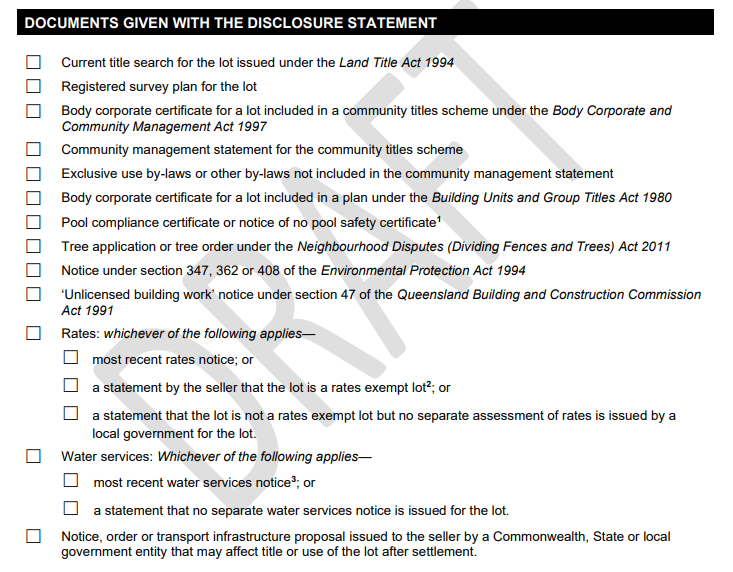

A draft Seller Disclosure Statement has been released, which contains a fair bit of detail about what information will be required. First of all: the seller will need lots of documents – see the list below:

The statement also asks for some ‘hard to find’ information, including:

“Does the property have any unregistered or statutory encumbrances over the lot that will not be released at settlement?”

Some sellers (and their advisors) may find it quite challenging to answer this question accurately.

The seller is also asked to confirm that there hasn’t been any unlicensed building work in the last 6 years (unless appropriate notice has been given) – I personally think this requirement will often be breached – and to make some other assurances about other issues which it is ‘impractical to search’.

The seller is not required to give information about other challenging topics like any history of flooding (in contrast to NSW and Vic, for example, where this is required), the structural soundness of any building, nor provide information on approval / use / planning issues.

Do sellers really have to do this?

Well – not yet! The Property Law Bill has not become law yet (at the date of publication of this article). But it’s definitely “coming soon”.

(Once the Bill does become law, and commences) failure to give the statement, or relevant documents, pre-contract is likely to give the buyer a right to terminate, with that termination right running right up to settlement.

There are some exceptions to the disclosure requirements for related party transactions, and where there is a sophisticated buyer (see s.100 of the Property Law Bill for more detail).

Property developers should take note: put and call options are both considered a sale (s.95 of the Property Law Bill), and so will trigger the requirement to give a seller disclosure statement.

What does the buyer’s termination right look like?

To terminate, a buyer must demonstrate a few things (I’ve added my emphasis in bold below):

- the statement or certificate is inaccurate or incomplete in relation to a material matter affecting the lot at the time it is given to the buyer; and

- at the time the contract is signed by the buyer, the buyer is not aware of the correct state of affairs concerning the matter; and

- if the buyer had been aware of the correct state of affairs concerning the matter, the buyer would not have signed the contract.

Tests which have ‘objective’ elements (like: “the statement… is inaccurate”) combined with ‘subjective’ elements (like: “material matter affecting the lot”) and ‘evidentiary’ elements (like: “buyer would not have signed the contract”) are difficult to apply in reality. Frankly – I think this could be clearer, and that some litigation to test the boundaries of this termination right is inevitable.

There are some similarities between this buyer termination right (in s.104 of the Property Law Bill) and the buyer’s right to rescind under NSW’s Conveyancing (Sale of Land) Regulation, and this is clearly intentional (see section 8.3 of QUT’s final report, where they discuss the basis for this recommendation). There has also clearly been a conscious effort to balance the rights of seller and buyer. There are no easy choices when setting the boundaries of this termination right, and there is no doubt that the authors of the QUT report have been thoughtful in making their recommendation.

What else can we expect from the Property Law Bill 2023?

The Property Law Bill also makes changes to the assignment of leases – bringing them more into line with the assignment of retail leases, (by giving a more effective release to the person transferring the lease and any guarantor of theirs – s.144(2) of the Property Law Bill).

There are also some ‘extension for disaster’ provisions in the Bill which soften (effectively, pause) the ‘time of the essence’ requirements which usually apply to property transactions in Queensland – in some narrow circumstances (for example, see s.81 of the Property Law Bill). Interstate parties should still bear in mind that the ‘time of the essence’ approach applies to the great majority of Qld property contracts, and that may be quite different to what you’re used to.

Further articles will deal with these further changes, and with the final details of the seller disclosure regime once it’s finalised.

Sellers, landlords, and property industry professionals should begin to prepare for these coming changes.